Insurance Solutions

Are You Self-Employed?

If you are self employed in the state of Oklahoma and have chosen not to purchase worker's compensation insurance on yourself and/or spouse, before you purchase any individual or group insurance policy, make certain it covers you and your employees on the job!

Not all insurance companies offer coverage for accidents that occur while on the job. Don't be lulled into a false sense of security by overlooking this critical point. It's bad enough if you are injured and are not able to work (thus not able to be paid) while you have no worker's compensation insurance. Imagine then finding out you're also not covered for the medical expenses required to get you back to health!

We have carriers that will cover you worldwide, 24/7, and offer additional accident/critical illness benefits that will cover your deductible as high as $10,000, for less than $70.00 per month for the entire family on the policy.

We also consult on the following personal insurance policies:

- Disability insurance

- Annuity insurance (retirement funds)

- Long-term care insurance

Money Question

Money QuestionEmployer group coverage in the state of Oklahoma is subsidized (paid for) by the employer at a minimum of 50%. An employer can contribute as much as they wish, but no less than 50% of the premiums to qualify for group coverage. Group coverage is traditionally more expensive than individual coverage for several reasons:

- Deductibles are generally lower ($0 to $3000)

- Co-insurance is generally lower (70/30, 80/20, 90/10, etc.)

- Coverage is generally richer because a group must cover all age ranges, genders, medical conditions, and maternity.

- No medical questions (pre-existing condition exclusions)

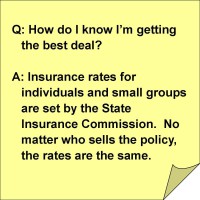

For these reasons, individual coverage is often found to be quite affordable because the individual can pick and choose the level of coverage, benefits, deductibles, and co-insurance they wish to include in their private coverage. Like many other types of insurance, the more you are willing to self-insure, the lower the monthly premium you will pay. Insurers charge premiums for each level of risk you want them to cover. By carrying a low deductible, the insurer is at risk for loss expense sooner and therefore must charge a higher premium. Conversely, the more you self-insure in the form of deductibles and co-insurance, the lower monthly premium you will pay.

Each individual must determine their own unique risk tolerance level, taking into consideration their current health status, medical and prescription drug needs, family history, income, and assets. Once you have determined what level of risk you are willing to cover out of your own pocket, you are ready to compare plans.

Insurers use actuaries to periodically analyze their loss expenses, morbidity rates, and premium levels to determine if their premium levels are adequate to cover expenses and generate a profit. They know that a percentage of their premium paying members will use little to none of their benefits thus generating a high level of profit from that group. They also know that a certain percentage of their members will use catastrophically high levels of benefits the insurer must be able to cover. Therefore, the healthy individuals truly pay for the benefits of the less healthy. This illustration is important because the actual claims for catastrophic expenses per insured individual is proportionately small when studied nationally. Less than 10% of insured individuals ever meet their deductible, much less their maximum out of pocket amounts. If this were not so, insurance companies would not be able to generate a profit or stay in business. The bottom line is that the odds are in your favor that you will not experience a catastrophic medical event.

Depending on your risk tolerance and assets, you may be willing to cover more of the potential risk of a medical catastrophe out of your own pocket. In doing so, you may save hundreds of dollars per month, and thousands of dollars per year. Unfortunately, unlike some life insurance and long term care plans, health insurance is not sold with a return of premium rider; you don't get your money back if you don't use the services! Therefore, I recommend all my clients carry the highest deductibles and co-insurance levels they can afford in order to keep the premium difference in their own bank accounts!

For Free Expert Help, Call Today: (405) 409-7884

Private - vs - Group Coverage

Looking for something else?

With years of experience in the business, we are confident that we can find a solution that suits your needs. Contact us for more information.