Medicare Supplements

Original Medicare A (Hospitalization) and B (Medical) are a senior's lifeline to affordable medical care, but, they don't cover everything. Each part has deductible(s) and there is a co-insurance you will be responsible to pay after Medicare has paid its' 80%. For that reason, many individuals choose additional coverage in the form of a Medicare supplement, to cover some or all of the eligible costs that original Medicare doesn't cover.

Supplements are insurance products that are offered by private insurance companies. They are secondary payers (original Medicare pays first, then the supplement pays), therefore you must have both part A and B of Medicare before you can purchase a supplement.

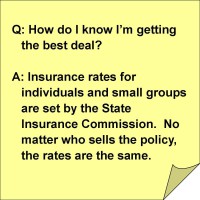

They are most affordable when you first turn 65, during which time you are also guaranteed coverage with no medical questions. The coverage offered by each type of plan (currently A through N) is regulated in 48 states in the US, which means the coverage provided in each plan is exactly the same regardless which company offers it. The differences are the extras that may be offered as part of the coverage, the premiums for the plans, and the pricing methods used that will govern future price increases.

Types of pricing methods:

- Issue Age

- Community Rated

- Attained Age

Click on the CMS link for more information on pricing methods: Medicare Supplement Pricing Methods.